Every day we discuss financial problems with our clients. Usually we start the conversation by asking our clients to give us a brief history—how did they get to the point of needing to discuss a bankruptcy? Most of the time the answers wouldn’t surprise you; job loss, divorce, medical bills, lay-off/mandatory furlough. BUT, it might surprise you to hear how frequently we hear a story that involves financial aid to adult children…ultimately leaving dear ole’ mom & dad flat broke.

Rearing a child is a struggle, whether you’re married, single, divorced, widowed, separated, etc. From a very early age parents generally struggle with saying “no” to their child, and setting boundaries. For example, how long do you let your baby cry in her crib before tending to her? When your sixteen year old son asks for a curfew extension to 11:00 on a weeknight, do you give in? Parents are constantly trying to strike the right balance between providing financial support and spoiling the child. Here are some things to consider before cosigning a loan for the 30 year old who is still living in your basement….

- How much retirement savings do you have? Everyone pities a poor grandma/grandpa. Living on a fixed income is rough! The money you’re saving for yourself today equals LESS of a burden on your adult children in the future. Saving for yourself could end up saving your kids a bundle, too!

- What is your child’s history with credit? Do they work three jobs until they’ve paid you off, or do they easily let things slide never even paying you back the $20 they borrowed last Thanksgiving?

- Are you helping your child stretch their wings for the first time, or is this another bailout? A lot of parents take this as a direct criticism to themselves…it’s not. Children grow up to be their own individuals. If your child consistently falters with debt repayment, it doesn’t mean you’ve failed them as a parent. You can still teach them a lesson even now….and it’s called tough love.

Attorney Dana Wilkinson is a bankruptcy attorney from South Carolina and she tells this story:

I once represented a woman whose house was in foreclosure. A Chapter 13 case can usually help with that, but this woman was in her 80s, and I was concerned about the feasibility of a five-year payment plan for someone in her situation. It turned out that she was supporting several grown children who lived with her, and was trying to save the home so they would have a place to live. But the mortgage on the house was far in excess of the property value. So I asked her what did she think would happen to the house when she was no longer around to make the payments. From her reaction, it was apparent that the question had never occurred to her before.

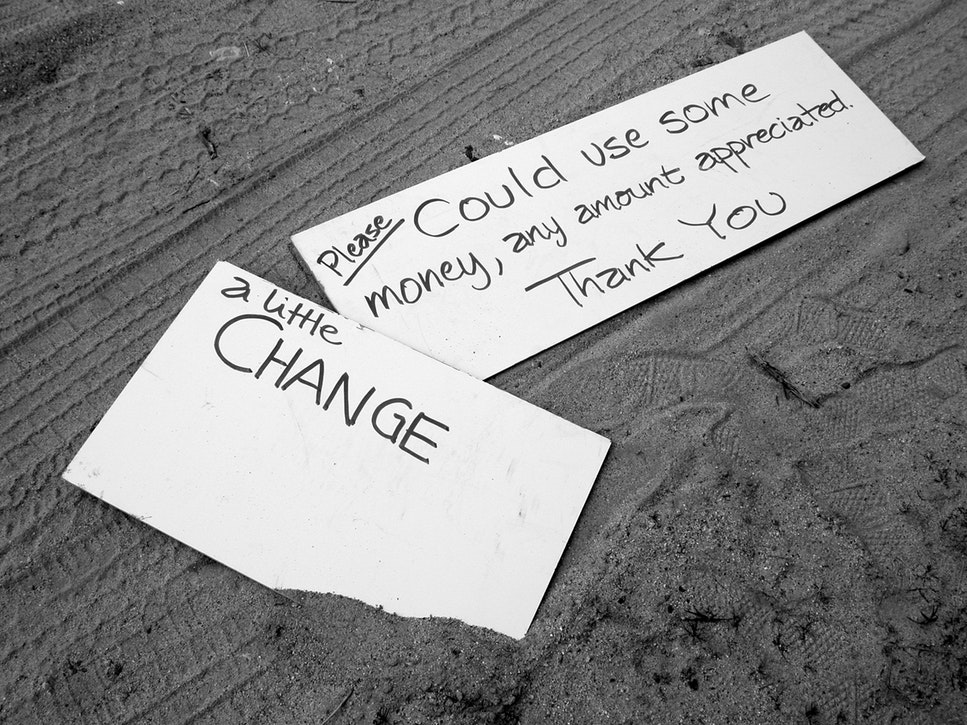

Sometimes the best, most loving thing we can do for our children is to say “no.” While parents have the instinctual need to protect and/or fix problems for our kids, sometimes the greatest gift we can give our children is to teach them to fix it themselves. Offering a hand up is much different than offering a handout.

If you, or someone in your family is struggling to make ends meet, and you’re having to consider filing bankruptcy e- mail our office at [email protected] for help.