Most people in debt are, at least initially, resistant to filing bankruptcy. Filing chapter 7 or chapter 13 is sometimes viewed as taking the easy way out, or looked at as a good way to ruin credit scores, or as a moral failing to be avoided. These feelings, combined with the inability to pay debts, result in a great deal of stress. The fact is that people do have pride, and no one wants to file bankruptcy if it canRead more

Sub-Prime Mortgages Reappear Under New Name

Do you remember this dirty word from not so long ago: “sub-prime?” In hindsight, its usage and manipulation by lending institutions catapulted our economy into the toilet…a move we’re still trying to recover from. With investors holding billions of dollars in properties they need to sell, two of the largest financial institutions, Wells Fargo and Citadel Servicing Corp., are back in the sub-prime game. Only this time they’re operating under the guise of a “Second Chance Purchase Program.” What DoesRead more

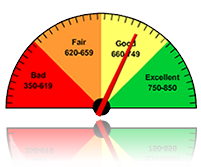

What Makes Up Your Credit Score?

Prospective clients often ask how their actions will impact their credit score. Much of what makes up the credit score is deliberately kept secret by the privately held corporation that developed credit scores. The three credit bureaus (Equifax, Experian, TransUnion) and individual creditors may also have different scores. Mainly, because they use a different credit score model or because not all creditors report to the same bureaus. But we know generally that the FICO score created by Fair Isaac is madeRead more

Credit Report Mistakes

The Fair Credit Reporting Act (FCRA) prohibits credit bureaus from reporting accounts that have been placed for collection or charged off for more than seven years. What Does This Mean For You? The creditor (known as a “furnisher” under the FCRA) is required to tell the credit bureau the date of the first delinquency because the seven years actually begins to run 180 days following that date. After the seven years expires, the debt’s “trade line” is supposed to ageRead more

Think That Pro Athletes Immune to Financial Trouble? Think Again.

Now that the Super Bowl is over (let’s not discuss the final score), high school and college athletes everywhere are dreaming of making it big in pro sports. Contracts worth millions of dollars are possible even for athletes not selected high in any pro draft. But, just like you and me and all of our clients, money problems aren’t foreign to even some of the wealthiest of pro sports players. In fact, there’s some evidence to suggest these wealthy playersRead more

Chapter 13 More Likely to Save Homes

A recent study confirms what many of us have known for some time: Filing Chapter 13 bankruptcy is one of, if not the best way to keep people in their homes Researchers from North Carolina looked at the cases of nearly 4,300 homeowners across the country. All of whom were more than 90 days late on their 30 year fixed rate mortgages. The study said that when homeowners filed bankruptcy, sales of their home were 70% less likely to occurRead more

Modifying a Chapter 13 Plan

Clients considering a Chapter 13 bankruptcy are often afraid they’ll be stuck in a payment plan they can’t afford if something changes. Your life doesn’t stop just because you file Chapter 13 bankruptcy so the chances of unforeseen circumstances disrupting a budget are good. Some clients go the entire 3-5 years without needing a modification but don’t worry if something happens that requires a change in the plan payment. Unforeseen Circumstances May Include Job loss car repairs home repairs medical bills, taxRead more

Cosigned Debt in Chapter 13

What Is Co-Signing? Co-signing a loan for someone means you’re making yourself fully responsible for repayment of the loan. While there may be an agreement between the co-signers as to who is going to make the payments, the lender doesn’t need to honor that agreement. They just want to see the loan repaid, regardless of who pays. What Happens When You Include Chapter 13? When a Chapter 13 bankruptcy is filed an “automatic stay” goes into place that prevents lendersRead more

Making Chapter 13 Plan Payments

What Should You Expect? Clients in Chapter 13 bankruptcy can make their Chapter 13 plan payments several ways. In Iowa the Chapter 13 trustee doesn’t accept personal checks and can’t do withdrawals from bank accounts but money orders or cashier’s checks can be mailed to the trustee each month. The debtors’ name and case number should be put on the money order or cashier’s check. The best way to make plan payments is a wage deduction order. These wage deductionsRead more

Mortgage Modifications

Mortgage Modifications Success & Failure A new report released in January 2013 from the NCLC reveals both the successes and failures of mortgage modification programs used by top mortgage lenders and servicers. As many as ten million homes are still estimated to be at high risk of foreclosure. With nearly four million foreclosures having been completed between 2007 and 2012. The report looks at the track record of the Home Affordable Modification Program, created in 2009 to address the needRead more