Do you remember this dirty word from not so long ago: “sub-prime?”

Do you remember this dirty word from not so long ago: “sub-prime?”

In hindsight, its usage and manipulation by lending institutions catapulted our economy into the toilet…a move we’re still trying to recover from.

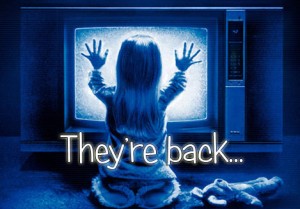

With investors holding billions of dollars in properties they need to sell, two of the largest financial institutions, Wells Fargo and Citadel Servicing Corp., are back in the sub-prime game.

Only this time they’re operating under the guise of a “Second Chance Purchase Program.”

What Does This Mean?

According to a recent article in Reuters:

“The bank is looking for opportunities to stem its revenue decline as overall mortgage lending volume plunges. It believes it has worked through enough of its crisis-era mortgage problems, particularly with U.S. home loan agencies, to be comfortable extending credit to some borrowers with higher credit risks.”

So far few other big banks seem poised to follow Wells Fargo’s lead, but some smaller companies outside the banking system, such as Citadel Servicing Corp, are already ramping up their subprime lending.

To avoid the taint associated with the word “subprime,” lenders are calling their loans “another chance mortgages” or “alternative mortgage programs.”

If you’re considering purchasing or refinancing a home be sure you understand all the ramifications of the loan programs you’re using.