.There are two very important statutes that serve to protect consumers from some of the consequences of too much debt. The first is the United States Bankruptcy Code. The other statute is the Fair Debt Collections Practices Act or FDCPA. Both statutes individually can help consumers. When you combine the two that is when some really good things can happen. United States Bankruptcy Code First, the Bankruptcy Code allows for the discharge of certain types of debt. If you findRead more

What’s your partner not telling you about finances?

Are you keeping your finances a secret? Are you keeping it from your spouse, your children….maybe even from yourself. Of course everyone wants to hear if you’re doing well in life. We readily “brag” on a booming business, a new promotion, the birth of a child. What we don’t disclose to one another is our debt (even though nearly everyone’s got it), and this can ruin relationships. We see it everyday. A couple comes to us as their financial “last straw”.Read more

Creditors Send 1099s When Debt Forgiven

Many of our clients are receiving Form 1099s from creditors reporting income to the Internal Revenue Service. This “income” is actually debt the creditor forgave or wrote off. To the IRS, this forgiveness of debt is considered taxable income just as if you had earned wages from employment. Receiving the 1099 can be potentially harmful if you do nothing to respond, but there are some exceptions that can help you avoid the tax liability. The First Exception The first exceptionRead more

Credit Report Mistakes

The Attorney General of Mississippi has filed a lawsuit against Experian, which, along with Transunion and Equifax, make up the three largest credit reporting companies. These companies collect information about consumers and then sell it back to lenders, insurance companies and others. What Was The Problem? The problem is that these reports on consumers are frequently full of mistakes and misinformation. According to investigators with the Mississippi Attorney General’s office, Experian: mixed up reports of consumers with the same orRead more

Is This Debt Yours?

According to the Federal Reserve, one in seven Americans is being contacted by a debt collector. This is up from one in twelve just ten years ago. Where Is My Debt? With 4,500 debt collection agencies in the United States, people find it hard to keep track of who is collecting which debt. Debts are bought and sold so many times that in the bankruptcy schedules we prepare we often list multiple debt collection agencies for one debt just toRead more

Colorado Sues Debt Buyer

A lawsuit brought by the state of Colorado late last year sheds light on the world of buying charged-off consumer debt. What was the lawsuit about? In a lawsuit against several debt collectors and debt buyers, Colorado said the companies had purchased thousands of charged off debts from U.S. Bank and Wells Fargo for likely just pennies on the dollar. But even though the banks transferred the debts to the companies, no documents related to the debts were also transferred.Read more

Escaping the Debt Machine

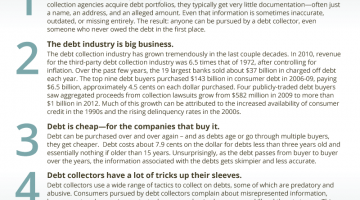

Over one billion contacts are made each year by debt collectors to consumers. The contingency fees raked in by third-party debt collectors exceeds many billions of dollars. The largest debt collector, NCO Financial which is owned by JPMorgan Chase, earns nearly $2 billion annually. A report describes both the enormous profits in the debt collection industry and the flaws in the legal system. Judges in Iowa estimate 85% to 90% of all collection lawsuits result in a default judgment becauseRead more

Payday Loan Company on Reservation Subject to Iowa Law

An important September 2013 ruling from the Iowa Department of Inspections and Appeals said that Western Sky Financial is subject to Iowa consumer laws. Western Sky sells the loans it makes to WS Funding, a subsidiary of CashCall, which services all the loans made in Iowa by Western Sky. The payday loans made by Western Sky can carry interest rates in excess of 135%. Western Sky and CashCall had argued that since it was owned by a tribal member andRead more

Debt Collection Complaints Increasing

Consumer complaints about debt collection have increased. Between 1999 and 2009, complaints to the Federal Trade Commision about collection agencies, debt buyers, collection attorneys and mortgage servicers increased from 10,000 to almost 90,000. The growth in the “debt buying” industry has led to many of these new complaints. Each year creditors write off hundreds of billions of dollars in debt that they believe to be uncollectible. But for the consumers who owe the debt the story doesn’t end there. ForRead more

Specialty Consumer Reporting Agencies Covered by FCRA

Most people are at least somewhat familiar with the Fair Credit Reporting Act (FCRA) requirement that the big three credit bureaus (Equifax, Experian and TransUnion) report only accurate information about someone’s credit. What is less known is that other agencies besides these three must also comply with the requirements of the FCRA. For instance, specialty reporting agencies that collect and disseminate information about consumers also covered. The Medical Information Bureau (MIB) collects and sells personal health information. CoreLogic SafeRent screensRead more