With $1.5 billion in student loan debt, many observers believe the economy would get a boost if at least some of that debt could be discharged in bankruptcy, like almost all other consumer debt. The excuses used for treating federal and private student loans differently in bankruptcy start to crumble when you look at how other debt is treated, even loans owed to other government agencies. A borrower can easily discharge in bankruptcy an unsecured loan to the Small BusinessRead more

Bankruptcy: Your New Years Resolution?

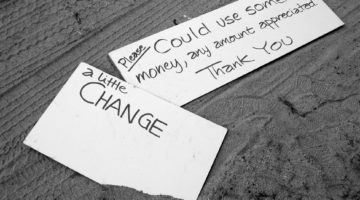

One of the more common questions we’re asked is: “Should I file bankruptcy?” Ultimately, the choice is yours, but perhaps we can help make the decision easier. Let’s address this fact first: No one wants to file bankruptcy. You do it because you need to, and it will improve your life in the long run. So, how do you know when you need to? Below are some factors we’ve identified that may help: You’re being garnished or receiving correspondence fromRead more

Credit Scores and Bankruptcy

One of the common concerns people have about filing bankruptcy is what impact it will have on their credit score. Although I think people worry too much about credit scores, there is some legitimate concern about making sure credit reports and credit scores don’t hinder the purchase of a new home. In a 2007 SmartMoney.com article, the author says: “In many cases, the damage done isn’t nearly as bad as expected. Over the long run, obtaining a score high enoughRead more

Iowa Bank of Mom & Dad: Are your kids leaving you broke?

Every day we discuss financial problems with our clients. Usually we start the conversation by asking our clients to give us a brief history—how did they get to the point of needing to discuss a bankruptcy? Most of the time the answers wouldn’t surprise you; job loss, divorce, medical bills, lay-off/mandatory furlough. BUT, it might surprise you to hear how frequently we hear a story that involves financial aid to adult children…ultimately leaving dear ole’ mom & dad flat broke.Read more

Don’t Make Bankruptcy Your Last Resort

The old adage is that consumers in financial stress should look to filing bankruptcy as their last resort. I’m sure the saying was created by lenders and others hoping to keep people from eliminating debt. But waiting to file bankruptcy can be dangerous. That’s why I think people in financial trouble should consider bankruptcy as a first resort instead. Figuring out how bankruptcy might help right from the onset of financial problems will make people better informed. It may helpRead more

How Do You Know If You Should File Bankruptcy?

Many clients wonder whether they are the only ones facing the kind of financial hardships that lead people to file bankruptcy. That’s obviously not the case since millions of people file bankruptcy every year. But it’s good to know what causes most people to have to file bankruptcy. Should You File? A study a few years ago by researchers at Harvard Law School looked at the causes of bankruptcy and found that more than two-thirds of debtors in bankruptcy hadRead more

Enforcing the Bankruptcy Automatic Stay

One of the most important aspects of bankruptcy law is the “automatic stay” that’s created the moment a case is filed. Automatic Stay This “stay” means that all efforts by a creditor to collect a debt or to enforce rights against a debtor’s property have to stop immediately. So these must end foreclosures garnishments tax offsets license revocations arbitration evictions any other proceeding to collect Sometimes a secured creditor is able to later get “relief” from the stay but unsecuredRead more

What Property Is Included In Bankruptcy?

It’s common for a bankruptcy client to wonder what property is part of the bankruptcy and whether they’re in danger of losing it. The simple answer is that ALL property owned at the time of filing is included in the bankruptcy but rarely does a debtor in Iowa ever lose any of it. Bankruptcy Filing When someone files bankruptcy, an “estate” is created that includes all of a debtor’s legal and equitable interest in any property held on the dateRead more

Discharging Income Taxes

Many people think taxes can’t be discharged in bankruptcy but that is not the case. Some taxes can be discharged but it’s important to know how old the taxes are and what kind they are to determine whether bankruptcy can be used to eliminate tax debt. Here is a shorthand way to determine whether taxes can be discharged There are four questions to ask and the correct answer is in parentheses following the question. 1. Are these income taxes? (Yes.)Read more

You’re Not Alone When It Comes To Bankruptcy

Our bankruptcy clients often comment to us, “I never thought this would happen to me.” Well, just who does bankruptcy happen to? The stigma of bankruptcy has caused many false concerns and unnecessary speculation. As we all know, life can take unexpected turns. Job loss, divorce, sickness, and failed business ventures occur at the most inopportune times and can send our finances into a tailspin. It’s important (now more than ever) to realize that bankruptcy isn’t exclusive to the poorestRead more

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- Next Page »